“[The gas tax] is the only tax in Massachusetts that goes up without a vote”

-State Representative Geoff Diehl of Whitman.

Supporters of Question 1 on the Commonwealth of Massachusetts’ November 2014 ballot want to frame their argument this way. They want you to think indexing is a dirty underhanded trick by politicians to automatically increase taxes, and that no other tax increases automatically.

In doing so, supporters of Question 1 think we’re dumb. The other two state taxes people pay a lot into are totally indexed and increase automatically over time. I’ll explain.

Automatic increases in tax revenue via the Sales Tax

I’ll use an example to show how the sales tax – even while the rate is fixed – increases revenue to the state coffers over time. Suppose you bought a washing machine in 2010 at a price of $500. You would have paid 6.25% sales tax on the machine, amounting to $31.25 in tax (you could not wait for a “sales tax holiday”, you had laundry piling up). Now just 4 years later there was a minor mishap that destroyed your washing machine and you need a new one. You like your old machine and go shopping for the same make & model, or the closest match you can find.

What you find is that – even in these years if recession – there has been inflation. The cost of consumer goods rose on average 9% from 2010 to 2014 (annual average of 237.9 for 2014 divided by annual average of 218.1 for 2010). Your replacement washing machine will cost you (or your insurance company) $545. Sales tax on that purchase is $34.06. You paid an extra $2.81 in sales tax even though the sales tax rate remained he same. In the abstract, sales tax literally “increases without a vote” every year as the average cost of goods and services increases.

In my opinion however however this is perfectly fair and reasonable. As inflation increases the cost of goods and services, the cost of governing goes up. And the automatic increase baked right into the sales tax should raise revenue proportionate to that increase.

Automatic increases in revenue via the Income Tax

The state income tax is a flat 5.3% on salary & wages. Most people (hopefully) earn more income as time passes. So as an illustrative example, let’s pretend you have a job with starting pay of $40k. Your pay rises over the years with cost of living increases at the rate of inflation and you get a couple of merit pay increases. A few years later your pay is $50k, a 20% increase over the starting pay (to make the math simple).

Let’s look at the Massachusetts income tax burden on this salary. Using an online tax calculator (and for for simplicity I’m going to take all the default values), here are the resulting tax burdens for the starting and end pay rates:

- $40k income: tax owed to MA is $1,869.

- $50k income: tax owed to MA is $2,394.

Notice two things:

- First we see that even though the marginal income tax rate did not increase, our tax burden increased roughly 20%. That’s right, inflation again – your cost of living pay raises (as well as merit based pay increases) have a side effect of increasing your tax burden.

- Also notice the trick: your tax burden didn’t increase exactly 20% like your pay did. A flat 20% increase would result in a tax burden of $2,243 on $50k ($1,869 * 1.2). No, instead you owe $2,394, a full $151 more. Why this happens is simple: it’s because the “standard deduction” is a fixed number – it doesn’t increase as your pay rises. So while your raw tax (5.3% of your income) increases proportional to your increasing pay, your standard deduction remains a fixed amount.

Note that I don’t think the second point above is in any way unfair. I pointed it out to show that even though the Massachusetts income tax rate is a fixed 5.3%, a person’s tax burden increases at a rate higher than their pay increases. Therefore the income tax is also a tax that increases automatically without the legislature having to vote for an increase.

Why we need automatic increases in the gas tax

Roads are important, and regardless of how much or little a single person drives, we all need roads. Emergency services (police, ambulance), deliveries of goods and services to stores or right to your door, and general transportation (individuals getting to & from work, doctor’s appointments, etc.) all depend on roads. And while roads are indeed important, their construction, maintenance and operation does not come cheap. Somebody has to pay for the roads. Why not tax those who use them, and tax at a rate at or near the true cost of the roads?

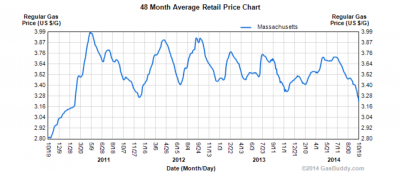

The chart below is from an article describing the Massachusetts gas tax through its history. Every time the graph spikes upward, reading from left to right, the legislature was bold enough to raise the gas tax. See how rare an event that is? The latest increase took 20 years to happen. Meanwhile, inflation continues year over year, never having to pander to an electorate to remain in power.

MA gas tax purchasing power over time

And there’s one more thing you should know about using a gas tax to finance roads. Even an indexed gas tax will fail in the long term! This is because cars are getting more efficient (more miles to the gallon means less tax revenue per mile), even while they get heavier (more road wear & tear per mile). Electric cars pay nothing at all in gas tax. These factors combine and conspire to erode the buying power of an indexed gas tax which will get worse with each passing year (i.e., if you want to ‘stick it to the man’ and dodge the gas tax, buy an electric car or ride a bike for transportation and/or errands!)

But what about the poor people?

Question 1 proponents suggest that a gas tax increase is an unfair burden to the poor. According to WBUR, State Representative Geoff Diehl contends it’s unfair to automatically increase a tax that disproportionately affects middle- and lower-class families whose incomes don’t increase with inflation. But this sounds disingenuous coming from a man who filed legislation to lower the minimum wage.

How we take care of the economically depressed people in our society is more important than most of us realize. But making it easier for poor people to drive is not a good solution for income inequality and social mobility. No, the truly poor people in America are the ones too poor to spend $7000 a year maintaining an automobile. An since presently only about 59% of the cost of roads in Massachusetts comes from user fees levied on driving (tolls and gas tax), people too poor to afford a car are actually paying to subsidize those who can. The 41% gap between what drivers pay and what roads cost is filled by diverting revenue from other taxes – sales, income, property taxes, etc. – to fund roads. Think of what this means to the non-driving poor: some of the sales tax they pay goes to subsidize roads for the affluent, and some of the general revenue of the Commonwealth that could otherwise fund programs benefitting the poor are diverted to pay for roads. This is the opposite of economic justice.

For people at a slightly higher income level – people who can afford a car but, but just barely – it’s still better for them to pay for smooth roads than suffer the consequences of deterioration. The recent gas tax increase was 3 cents. That’s a cost of about $2 a month* paid in small increments. It’s a far better cost (small payments over time) for someone barely making a living than having to suddenly & unexpectedly have to pay for a major car repair caused by deferred road maintenance. Having to pay a high price to keep the car on the road ~$100 for a blown tire, or ~$300 to 500 for steering and suspension repairs (if you know someone, use junkyards parts, and can go without your car for a week) can be catastrophic for somebody living paycheck to paycheck. Nay I say, the barely-getting-along driver is far better off with fully funded infrastructure at a low pro-life cost.

* Monthly cost of the gas tax increase based on 3 cents per gallon increase in tax, 15k miles driven per year and 18 mpg mileage.

Finally, this:

I hate to keep using State Representative Geoff Diehl in all my examples, but frankly he’s the only elected official I’ve seen quoted in the press. And sadly all his arguments are fallacious. A piece on MassLive.com cites “Prices for food and other consumer goods would rise, Diehl said, as shipping costs go up with higher gas taxes. Property taxes could also be affected as cities and towns pay more to operate police cars, fire trucks and other vehicles, he added.”

Well I’m no economist but it’s obvious that the cost of vehicle fuel has a minuscule influence on the price of goods of services. This analysis is a little dated, but the fundamentals are clear: the price of gas has very little to do with the Consumer Price Index and therefore has little to do with the retail cost of goods and services.

We can look at this another way, too. Charting the full cost of gas (since… that’s what people actually pay at the pump) over the last 4 years, we see wild fluctuations in the price of gas over short periods of time.

Meanwhile there is no evidence that these fluctuations have any perceivable influence over the cost of consumer goods or the cost of policing and other emergency responder services (the dominant factor in the cost of these services is personnel).

Meanwhile there is no evidence that these fluctuations have any perceivable influence over the cost of consumer goods or the cost of policing and other emergency responder services (the dominant factor in the cost of these services is personnel).

Conclusion

Don’t be fooled by hollo rhetoric about Massachusetts gas tax indexing. Instead, support a dependable funding stream that will pay for bridge and road repair, resulting in an infrastructure that supports the economy of the Commonwealth and the wellbeing of all its citizens.